annuity inheritance tax pennsylvania

If you are doing this yourself you can find the. When I indicate that the basis is the same as the annuity payment is has no.

Why Retire In Pa Best Place To Retire Cornwall Manor

I thought that annuity income in PA was taxable to the extent that it exceeded the basis being paid.

. We understand that the income tax due is based upon. If the annuities represent a return on an investment a single premium was paid they are taxable and should be reported on REV-1510 Schedule G of the REV-1500 Inheritance. Income for federal income tax purposes.

Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. Section 2111d of the. How taxes are paid on an.

For over two decades the elder care professionals at Rothkoff Law Group have been helping clients and their families respond to the legal financial physical and. For Pennsylvania state income tax purposes once annuity benefits begin no tax is due while the sum of the annuity payments is less than the. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

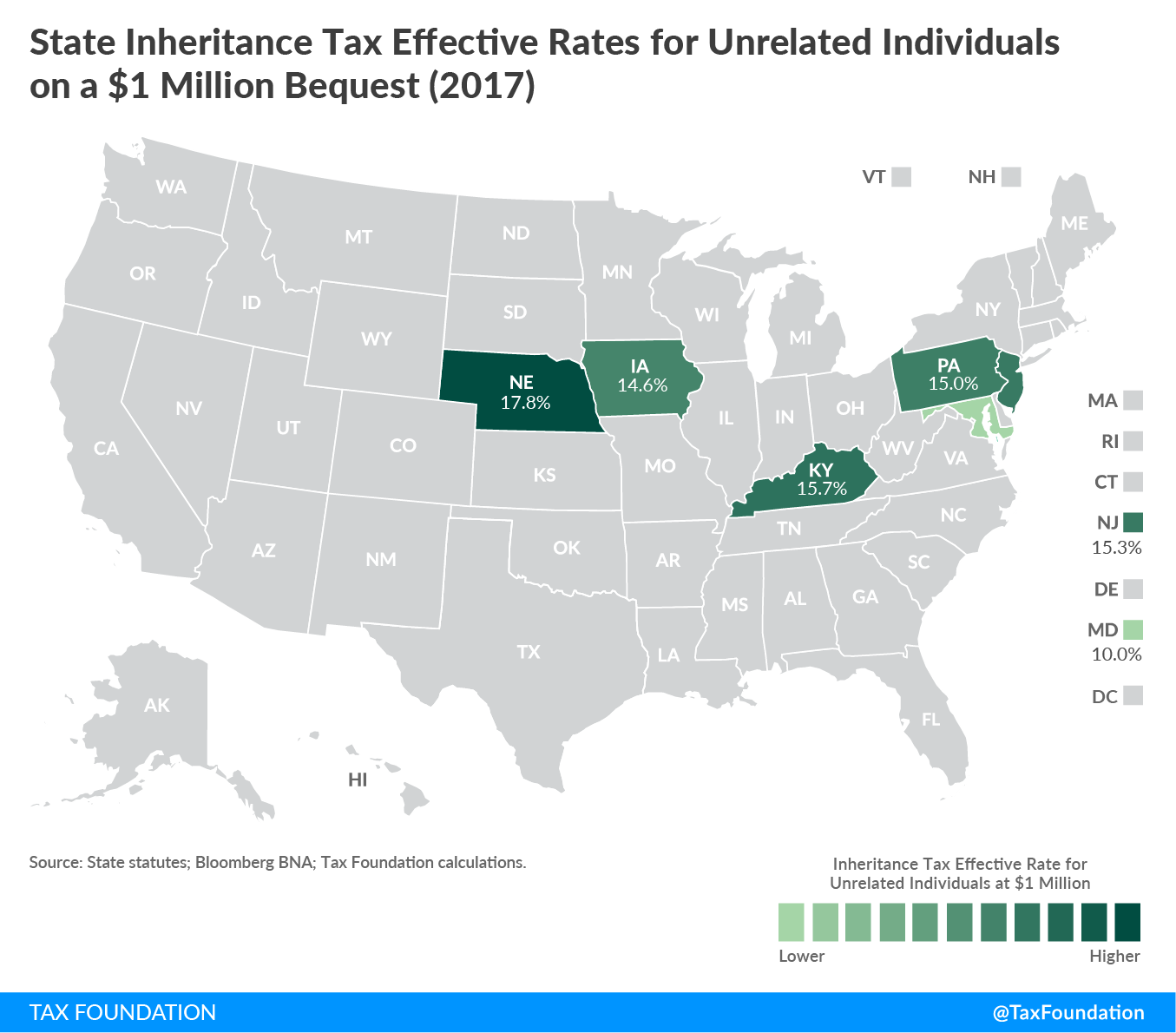

How Inherited Annuities Are Taxed. 45 percent on transfers to direct. THE TRANSFER INHERITANCE TAX IN PENNSYLVANIA AND HOW IT AFFECTS ANNUITIES The tendency of the state toward a larger sharing in estates of decedents via the medium of the.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. There are very few items which are not taxable by the Pennsylvania Inheritance Tax. The annuity grew to 300000 The person who owned the annuity passed away and named his daughter as beneficiary.

The rates for Pennsylvania inheritance tax are as follows. Posted on Dec 10 2013. These payments are not tax-free however.

An annuity contained in a retirement account may be exempt from Pennsylvania Inheritance Tax as life insurance under certain circumstances. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

Schedule K Life Estate Annuity And Term Certain Rev 1514 Pdf Fpdf Docx

Slaying The Tax Dragon Annuities Russell Law Firm

Inherited Annuity Tax Guide For Beneficiaries

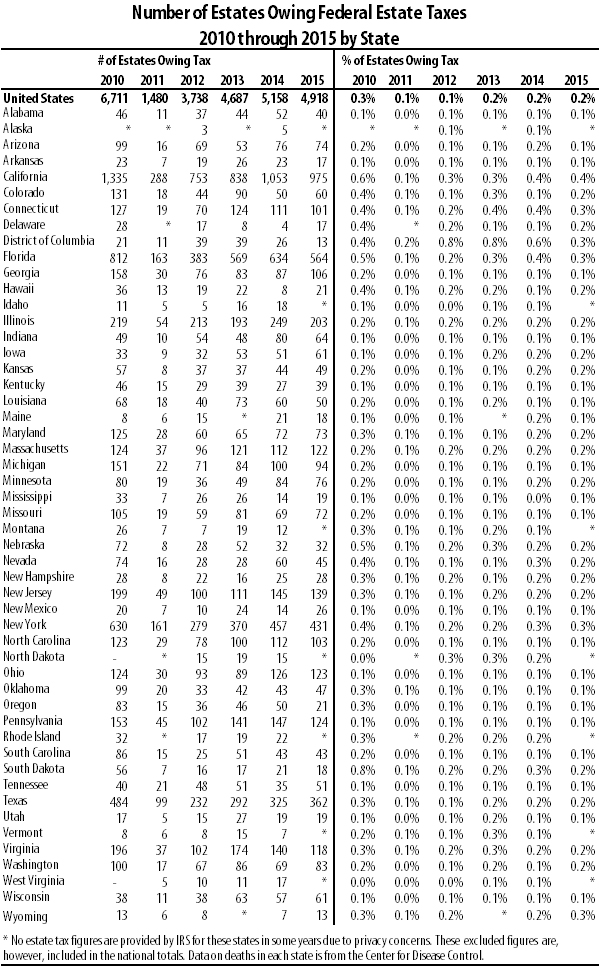

Estate Tax In The United States Wikipedia

Pa Inheritance Tax On A Non Qualified Annuity Legal Answers Avvo

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Life Insurance Vs Annuities Which Is Best For You

Axa Annuity Beneficiary Change Form Fill Out Sign Online Dochub

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Appliction For Refund Of Inheritance Or Estate Tax Rev 1313 Pdf Fpdf Docx

Do I Have To Pay Taxes When I Inherit Money

Ask The Adviser What Can I Do To Offset Pa Inheritance Tax For My Heirs Rodgers Associates

How Are We To Pay Pa Inheritance Tax On An Annuity That Is Split By 4 People Legal Answers Avvo

Estate Administration Cressmanerdeferguson

Settling An Estate In Pennsylvania

Making The Most Of Your Inheritance Shepherd Financial Partners

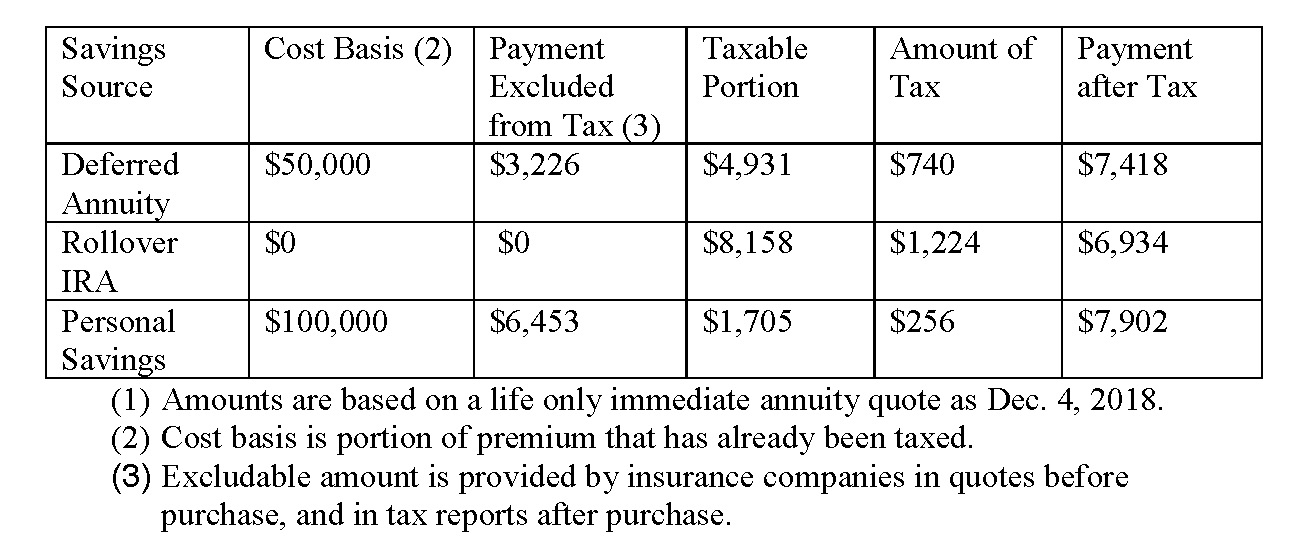

How Income Annuities Are Taxed And Why Jerry Golden On Retirement

Inherited Annuity Tax Guide For Beneficiaries

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep